So, its again that time of year when everyone scrambles to file their Income Tax returns. Being the master procrastinator that I'm, I wait till the last day to file it & start pulling out my hair when things don't go right. Every year I file the returns, but then I forget how I did it. So I'll try to pen down what needs to be filled up in the online e-Filing: http://incometaxindiaefiling.gov.in/

Considering that you already have registered, click the login as shown below:

Login with your PAN credentials & Date of Birth:

Keep the Form-16 from your employer before you start the filing process. Click on "Quick e-file ITR", Enter PAN, select ITR-1, select address option & click submit to start the process. Please note the Assessment year is 2016-2017 whereas the financial year would be 2015-2016

The "Total Amount Paid/Credited" in PartA1 above should be mentioned in E-FILE INCOME DETAILS section B3 "Income from Other Sources"

In case tax is to be paid by you, then you need to fill up Sch IT shown below (mentioned later under Tax paid):

Fill up the bank account details for refund & other bank account details if necessary:

In case of Tax Payable (D18), you can pay the amount online

Considering that you already have registered, click the login as shown below:

Login with your PAN credentials & Date of Birth:

Keep the Form-16 from your employer before you start the filing process. Click on "Quick e-file ITR", Enter PAN, select ITR-1, select address option & click submit to start the process. Please note the Assessment year is 2016-2017 whereas the financial year would be 2015-2016

E-FILE: PERSONAL INFORMATION

Enter your personal information as shown below:E-FILE: INCOME DETAILS

Enter your income details from your Form-16 provided by employer as shown below.

In case you have sources of income other than salary, please refer Form26AS (mentioned later).

FORM 26AS Tax Credit

To download/view Form 26 AS, please follow the below steps:

The "Total Amount Paid/Credited" in PartA1 above should be mentioned in E-FILE INCOME DETAILS section B3 "Income from Other Sources"

E-FILE: TAX DETAILS

Check the tax details as per Form16 & Form26AS:

In case tax is to be paid by you, then you need to fill up Sch IT shown below (mentioned later under Tax paid):

E-FILE: TAXES PAID AND VERIFICATION

Verify the final taxes paid & check whether any Tax refund or Payment is applicable.Fill up the bank account details for refund & other bank account details if necessary:

In case of Tax Payable (D18), you can pay the amount online

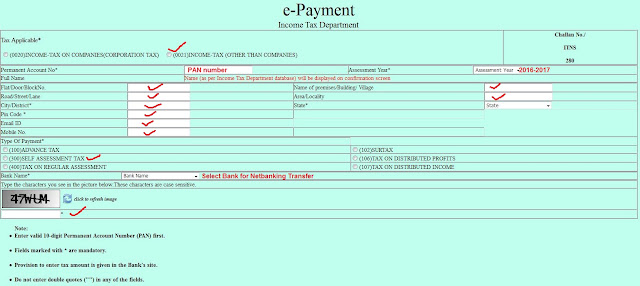

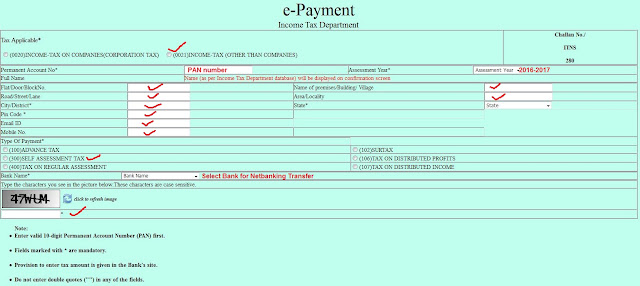

ONLINE TAX PAYMENT

Go to this link for e-Payment: https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

Select CHALLAN NO./ITNS 280

Fill up details as shown below:

Click Proceed & it will take you to the Netbanking page.

Enter Tax to be paid (amount in D18) under "Basic Tax / Income Tax" and confirm payment.

Fill up the challan no, BSR code & Date of Payment in SchIT "Details of Adavnce Tax and Self Assessment Tax Payments" below:

Go to TAXES PAID AND VERIFICATION section & check if D18 amount shows 0, after filling the Self assessment tax details above.

Fill up the other bank details (if applicable) & complete the verification:

Click SUBMIT once done!!

DISCLAIMER: Please note that the information mentioned is as per what I had filed, please don't consider this as a standard guide & I'm can't be held responsible in case your e-filing goes wrong :)

If you have any clarifications, please refer with a TRP or other tax professionals.

Thank you!!

PS: A big hug to my friend Girisha. R for guiding me through this process. Thanks a bunch my friend!! :)

VISAKH.

No comments:

Post a Comment