So, its again that time of year when everyone scrambles to file their Income Tax returns. Being the master procrastinator that I'm, I wait till the last day to file it & start pulling out my hair when things don't go right. Every year I file the returns, but then I forget how I did it. So I'll try to pen down what needs to be filled up in the online e-Filing:

http://incometaxindiaefiling.gov.in/

Considering that you already have registered, click the login as shown below:

Login with your PAN credentials & Date of Birth:

Keep the Form-16 from your employer before you start the filing process. Click on "Quick e-file ITR", Enter PAN, select ITR-1, select address option & click submit to start the process. Please note the Assessment year is 2016-2017 whereas the financial year would be 2015-2016

E-FILE: PERSONAL INFORMATION

Enter your personal information as shown below:

E-FILE: INCOME DETAILS

Enter your income details from your Form-16 provided by employer as shown below.

In case you have sources of income other than salary, please refer Form26AS (mentioned later).

FORM 26AS Tax Credit

To download/view Form 26 AS, please follow the below steps:

The "Total Amount Paid/Credited" in PartA1 above should be mentioned in E-FILE INCOME DETAILS section

B3 "Income from Other Sources"

E-FILE: TAX DETAILS

Check the tax details as per Form16 & Form26AS:

In case tax is to be paid by you, then you need to fill up Sch IT shown below (mentioned later under Tax paid):

E-FILE: TAXES PAID AND VERIFICATION

Verify the final taxes paid & check whether any Tax refund or Payment is applicable.

Fill up the bank account details for refund & other bank account details if necessary:

In case of Tax Payable (D18), you can pay the amount online

ONLINE TAX PAYMENT

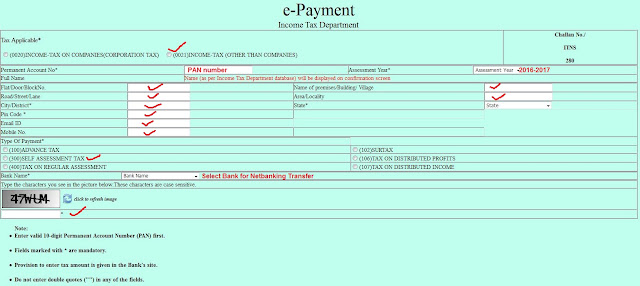

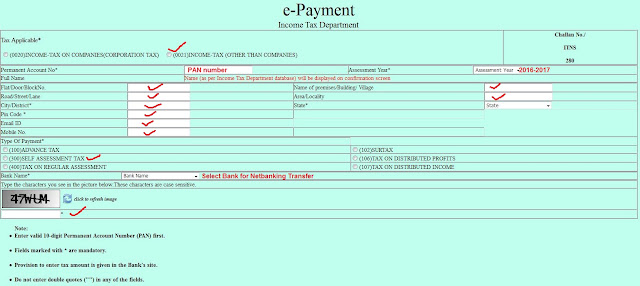

Select CHALLAN NO./ITNS 280

Fill up details as shown below:

Click Proceed & it will take you to the Netbanking page.

Enter Tax to be paid (amount in D18) under "Basic Tax / Income Tax" and confirm payment.

You'll get an acknowledgement with the BSR code & Challan number as shown below:

Fill up the challan no, BSR code & Date of Payment in SchIT "Details of Adavnce Tax and Self Assessment Tax Payments" below:

Go to TAXES PAID AND VERIFICATION section & check if D18 amount shows 0, after filling the Self assessment tax details above.

Fill up the other bank details (if applicable) & complete the verification:

Click SUBMIT once done!!

DISCLAIMER: Please note that the information mentioned is as per what I had filed, please don't consider this as a standard guide & I'm can't be held responsible in case your e-filing goes wrong :)

If you have any clarifications, please refer with a TRP or other tax professionals.

Thank you!!

PS: A big hug to my friend Girisha. R for guiding me through this process. Thanks a bunch my friend!! :)

VISAKH.